- #HAWAII TRANSIENT ACCOMMODATIONS TAX HOW TO#

- #HAWAII TRANSIENT ACCOMMODATIONS TAX REGISTRATION#

- #HAWAII TRANSIENT ACCOMMODATIONS TAX CODE#

#HAWAII TRANSIENT ACCOMMODATIONS TAX HOW TO#

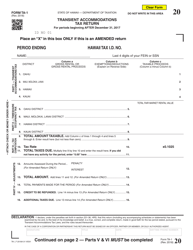

If I don’t have to file a separate return, how will you know how to apply my payment? A payment voucher will be available online for your use. However, the MCTAT payment, will have to be separately remitted to the County Director of Finance (“Director”).

No, a report filed with DOTAX will be deemed as filed with the County. You will then have to remit the payment separately to the appropriate jurisdiction.ĭo I have to file a separate return with the County of Maui? If a single payment is made to the State that in- cludes both State and County TAT, you will receive a refund of the portion not owed to the State. The County will maintain a separate County TAT account for each taxpayer. Act 1 (2021), prevented DOTAX from assisting the counties with billing and collection of the County TAT. Separate payments will need to be made to the State Department of Taxation (DOTAX) and to the County Director of Finance. Every annual reconciliation thereafter will cover the entire previous calendar year and will be due on April 20.Ĭan I just make one payment for both the State and County portions? The first annual reconciliation is due on April 20, 2022, covering the period Novemthrough December 31, 2021. The timing of payments will coincide with the State. For quarter- ly filers, the first deadline covering the period Novemthrough December 31, 2021, will be due on January 20, 2022. Since the effective date is November 1, 2021, those who pay the State TAT on a monthly basis will also need to remit their first payment to the County on or before December 20, 2021.

The effective date for the MCTAT is November 1, 2021. This also applies to every transient accommodation broker, travel agency, and tour packager who arranges transient accommodations at non-commissioned negotiated contract rates.

#HAWAII TRANSIENT ACCOMMODATIONS TAX REGISTRATION#

All operators, plan managers, transient accommodations brokers, travel agencies, or tour packagers within the County must hold State registration in accordance with Sections 237D-4 and 4.5, HRS. The general rule of thumb is if you pay the State TAT, you will need to pay the County. 101 (2021), Draft 1 establishing a rate of 3 percent on all gross rental, gross rental proceeds, and fair market rental value considered taxable under the definitions of Section 237D-1, Hawai`i Revised Statutes (HRS).

On October 1, 2021, Maui County Council passed Ordinance No.

#HAWAII TRANSIENT ACCOMMODATIONS TAX CODE#

What is the County Transient Accommodations Tax?Īct 1, in lieu of the counties receiving a distribution from the State, provides authority for a County-wide Transient Accommodations Tax within the Maui County Code which implements the MCTAT.

0 kommentar(er)

0 kommentar(er)